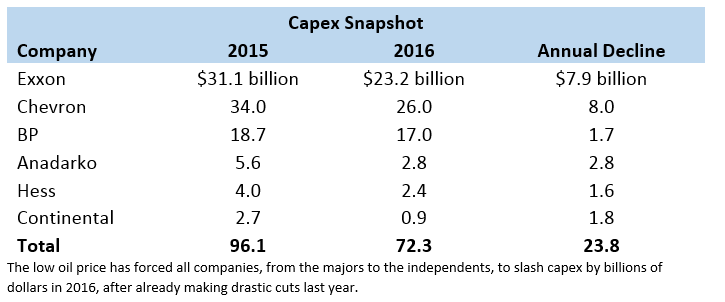

(Vox) One of the central planks in President Obama’s climate plan is a rule to ratchet up fuel economy standards through 2025. New US cars and light trucks are supposed to get better and better mileage with each passing year. At least, that was the dream. But now cheap oil is messing that up.

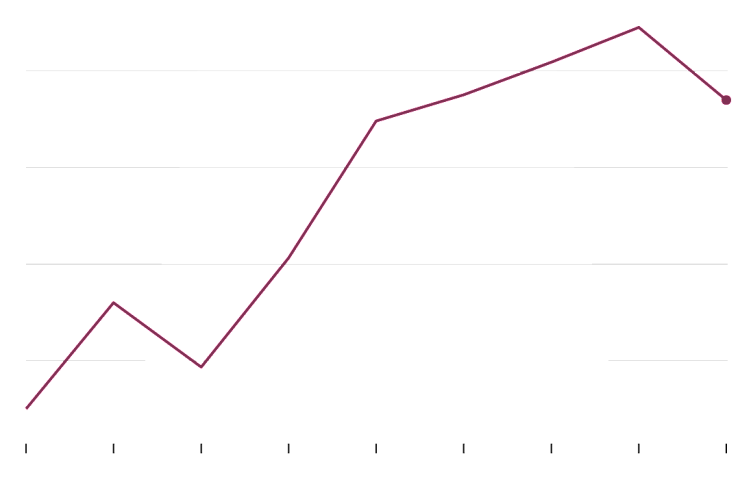

Recent data from the Transportation Research Institute at the University of Michigan shows that overall fuel economy for new cars, SUVs, vans, and pickup trucks sold in the United States has been stagnating ever since oil prices crashed last year