(Solar Industry) As the New England Patriots and Atlanta Falcons battle it out on the field this Sunday, renewable energy will power Super Bowl LI. NRG Energy Inc. and subsidiary Reliant, a retail electricity provider in Texas, have teamed up with the National Football League (NFL) to provide 100% Green-e certified renewable energy to NRG Stadium, site of Super Bowl LI, and the George R. Brown Convention Center, location of the NFL Experience and other NFL celebrations in Houston.

News

The World’s Sustainable Energy Capacity is Absolutely Surging Right Now.

(UN Dispatch) A recent report by the International Energy Agency revised upward the potential for growth in renewables, and found that sustainable energy capacity now equalled that of coal. In other words, the IEA found that its previous estimates for how fast renewable energy would grow we’re too slow. Countries are bringing sustainable sources of electricity like wind turbines and solar panels online faster than the international agency expected.

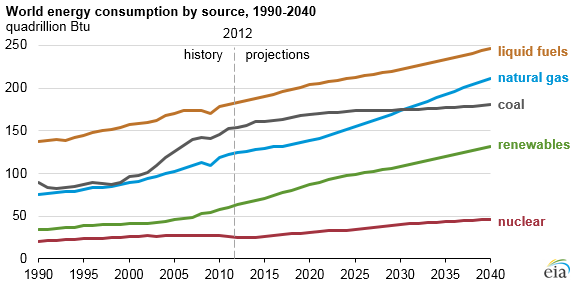

EIA projects 48% increase in world energy consumption by 2040

The U.S. Energy Information Administration’s recently released International Energy Outlook 2016 (IEO 2016) projects that world energy consumption will grow by 48% between 2012 and 2040. Most of this growth will come from countries that are not in the Organization for Economic Cooperation and Development (OECD), including countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia, including China and India, accounts for more than half of the world’s total increase in energy consumption over the projection period.

IEA: India could drive oil demand growth

(CNBC) Global oil demand growth is forecast to ease further in 2016, the International Energy Agency (IEA) said on Thursday, predicting a slowdown in demand from some of the world’s top consumers and a rise in demand from one particular economy.

Growth in global oil demand will ease to around 1.2 million barrels a day in 2016, the IEA said in its latest monthly report published on Thursday, below 2015’s 1.8 million barrels a day (mb/d) expansion. This would take place, the IEA said, as “notable decelerations take hold across China, the U.S. and much of Europe.”

World’s second biggest coal miner at risk of bankruptcy

(Business Insider) Peabody Energy, one of the world’s biggest producers of coal, has warned that it is at risk of going bankrupt in the very near future, thanks to a lack of “sufficient liquidity to sustain operations and to continue as a going concern” caused largely by the continuing downturn in the coal mining industry.

In a regulatory filing on Wednesday, the US-based producer said: “There can be no assurance that our plan to improve our operating performance and financial position will be successful.” Peabody has undertaken a huge programme of cost-cutting in recent years to stave off a massive crash in the price of the commodity.

Investors Increasingly Bullish on Oil and Gas

(NY Times) It was one of the darkest periods of the oil market slump. The global economy was showing fresh signs of slowing, and crude prices were collapsing so steeply that virtually every well in America was unprofitable.

But when Diamondback Energy went out to raise $226 million worth of new stock that week in the middle of January, the oil and gas company found more buyers than it could accommodate. It had to nearly double the amount of shares it sold, to four million.

Since Diamondback issued equity that day, the company’s share price has increased more than 29 percent.

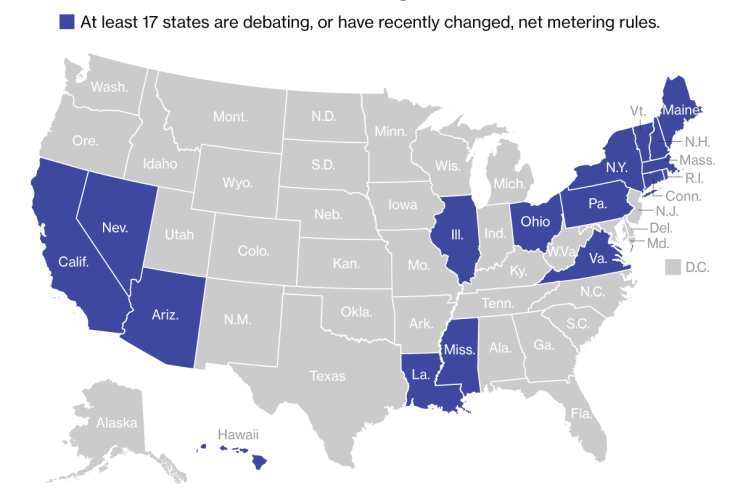

Solar Debate Heads to Cold, Foggy Maine, Where Panels are Scarce

(Bloomberg) Despite long winters, a famously foggy coastline and relatively few solar panels in operation, Maine is emerging as a pivotal U.S. state for determining how consumers will pay for power generated by the sun.

U.S. solar installations have boomed more than 10-fold in the past five years, driven in part by a policy known as net metering that requires utilities to pay their customers for extra solar energy from rooftop panels. That’s lowered consumers’ monthly bills, and also cuts into revenue for utilities that still must contend with their own fixed costs — spurring conflict between traditional power companies and solar providers.

New Grid Storage Technology Helps Integrate Renewables

(MIT Technology Review) Duke Energy installs batteries, ultracapacitors to cover power shortages and store energy for peak demand.

Developing cheap energy storage is a critical step in moving to renewables and away from fossil fuels as the primary source of electricity: it’s the only way such intermittent sources can supply power to the grid when the wind’s not blowing and the sun’s not shining.

Duke Energy, the nation’s largest utility, is trying a novel strategy to tackle this challenge. At its Rankin substation, in North Carolina , it has installed a system of hybrid energy storage that combines a battery from Aquion Energy and ultracapacitors from Maxwell Technologies .

Coal Power Waning: Nearly 5% Of US Capacity Retired In 2015 As Aging Plants Lose Ground

(International Business Times) U.S. coal power, once king of the energy mix, is getting old.

Utility companies retired nearly 18,000 megawatts of electric generating capacity in 2015, about 80 percent of which was conventional coal-fired power plants, the U.S. Energy Information Administration said this week . The majority of those retired coal units were built between 1950 and 1970, and their an average age is 54.

The amount of coal capacity retired last year represents nearly 5 percent of total U.S. coal capacity.

Why Big Retailers Are Going Solar

(Fortune) It’s about economics, not just environmentalism.

Years ago, big retailers and tech companies installed solar panels as a way to take an environmental stance. But these days it’s often an economic choice that is fueled by the promise of lower and less volatile energy costs.

On Tuesday, Whole Foods WFM -0.54% said that it planned a huge project to cover nearly one-fourth of its stores with solar panels. After construction is complete, Whole Foods says it could be among the top 25 biggest commercial U.S. solar suppliers alongside Walmart WMT 1.17% , Walgreens WBA -0.25% , and Target TGT -0.15% .

How cheap oil is undermining Obama’s fuel-economy rules

(Vox) One of the central planks in President Obama’s climate plan is a rule to ratchet up fuel economy standards through 2025. New US cars and light trucks are supposed to get better and better mileage with each passing year. At least, that was the dream. But now cheap oil is messing that up.

Recent data from the Transportation Research Institute at the University of Michigan shows that overall fuel economy for new cars, SUVs, vans, and pickup trucks sold in the United States has been stagnating ever since oil prices crashed last year

17 Governors Agree to Pursue Clean Energy Goals

(Scientific American) The announcement by 17 governors yesterday to jointly pursue clean energy goals was perhaps most noteworthy in what it did not include—any mention of climate change.

That omission was necessary to bring a bipartisan swath of states together on energy efficiency and renewable energy, modernizing the electricity grid and promoting electric and alternatively fueled vehicles—all subjects often mentioned in the same breath as climate change.

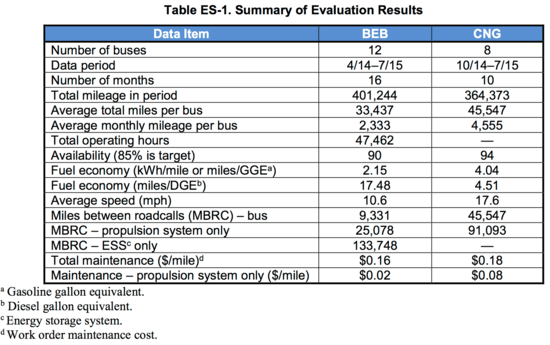

NREL electric bus analysis finds fuel economy nearly 4x CNG baseline buses

(Green Car Congress) Proterra battery-electric buses in service in a 12- vehicle demonstration by Foothill Transit in California offered significant fuel savings compared to similar conventional vehicles, according to a recently published analysis of the results of the demonstration by the National Renewable Energy Laboratory (NREL).

EIA: U.S. energy spending down sharply

(UPI) Investment in the mining and other extractive industries, including oil, declined in the United States by more than 30 percent last year, federal data show.

When measured as a share of total private U.S. investments, federal data show spending in the mining and exploration sector dropped from a 5 percent share in 2014 to just more than 3 percent last year.

A daily briefing from the U.S. Energy Information Administration said low crude oil prices are the major factor in the reduction in capital spending .

Obama Proposes $10/bbl Oil Tax, Dead on Arrival

(The Fuse) The Obama administration’s plan to tax oil companies to pay for investments in transportation offers a strategy to create long-term reductions in oil demand. However, given the gridlock in Congress, the state of the economy, and the challenges faced by the domestic oil industry, the proposal fails to meaningfully advance solutions to move the country away from oil.

Everybody Hurts: Oil Majors, Independents Drastically Cut Capex

(The Fuse) It seems fitting that oil prices fell back under $30 on the day that two major oil companies reported disastrous earnings results showing the damage of the past year and a half. The decline in prices that began in mid-2014 has wreaked havoc across all different types of companies—NOCs, IOCs, independents, oil majors, oilfield services—and there seems to be no respite in the short run. Companies are continuing to lay off staff, cut back on projects, and report eye-opening losses.

Ethanol pioneer ADM’s struggle reflects deepening industry woes

(Reuters) The world’s largest corn mill of global grain company Archer Daniels Midland is pictured in Decatur, Illinois March 16, 2020. When Archer Daniels Midland opened two of the country’s largest ethanol plants in Nebraska and Iowa six years ago, the biofuels market was on the cusp of a boom with prices and profits on the rise.

Now, the plants are more of a headache for the Chicago-based company, considered an industry pioneer, amid crushed margins and weak prices as the financial success of its almost 40-year- old business fades.

U.S. economy slows sharply as oil and gas slump deepens

(Reuters) The U.S. economy eked out anemic growth in the final three months of 2015, and the struggling performance of the oil and gas sector was a major contributor to the slowdown.

Real gross domestic product rose at an annualized rate of 0.7 percent in the fourth quarter, down from 2.0 percent in the third and 3.9 percent in the second, the Bureau of Economic Analysis (BEA) reported on Friday.

Monthly coal use for U.S. power fell to 35-year low in November: EIA

(Reuters) U.S power generation from coal fell to the lowest monthly level in 35 years in November 2015 as generators switched to cleaner and cheaper natural gas, according to federal data.

Gas overtook coal as the leading source of U.S. power for a fifth month in a row in November, according to the latest data available from the U.S. Energy Information Administration. The first month in history that gas overtook coal was April 2015.

The $50 Million Competition to Remake the American City

(Wired) In the next 30 years, the American population will rise by 70 million people. This being the future, those people will love ordering stuff online even more than people do now, which will prompt a 45 percent rise in freight volume . The nation’s roads, already crumbling because Congress likes bickering more than legislating, will be home to 65 percent more trucks.

That’s just one of the ways a report, released earlier this year by the US Department of Transportation, says a growing population will strain an already overloaded highway system. Eager to avert some of these problems and get people thinking about the mobility of tomorrow, today the DOT is launching the Smart City Challenge, a contest that invites American cities to take advantage of new technologies that could change how we move.

Oil price plunge isn’t all good news for the economy

(CNBC) The recent plunge in oil prices should be — mostly — good for the U.S. economy.

Cheaper fuel brings big savings for consumers and businesses — several hundred billion dollars since prices crashed from more than $100 a barrel to less than $30. Gasoline, diesel and heating oil make up about two-thirds of the roughly 20 million barrels of oil consumed in the U.S. every day.

Lower oil prices are also helping cut the U.S. trade deficit by slashing the cost of imported oil. And they’ve brought lower operating costs for shippers and other transportation companies, which helps boost profits and hold the line on the cost of travel and moving goods.

All in, the sustained drop in crude prices should add roughly half a percent to U.S. GDP, according to the Dallas Fed.

NOAA Model Finds Renewable Energy Could be Deployed in the U.S. Without Storage

(IEEE Spectrum) The majority of the United States’s electricity needs could be met with renewable energy by 2030—without new advances in energy storage or cost increases. That’s the finding of a new study conducted by researchers from the National Oceanic and Atmospheric Administration (NOAA). The key will be having sufficient transmission lines spanning the contiguous U.S., so that energy can be deployed from where it’s generated to the places where its needed.

This Time, Cheaper Oil Does Little for the U.S. Economy

(NY Times) It has been a truism of the American economy for decades: When oil prices rise, the economy suffers; when they fall, growth improves.

But the decline of oil prices over the last two years has failed to deliver the usual economic benefits.

As oil prices have fallen to levels not seen since 2003 — sagging below $27 a barrel on Wednesday before rebounding to about $30 on Thursday — many experts now say they do not expect lower prices to bolster the domestic economy significantly in 2016.

IMF: Oil price collapse is a drag on global economy

(Economic Times) Lower crude prices would normally stimulate some demand in countries where it is a key household and business cost, and spur more economic activity, the Fund said in its updated outlook on the world economy.

However, it said, after a 70 per cent fall in prices over 18 months, other factors have dampened the expected gains from that decline.

Report: Increasing Global Renewable Energy Would Increase Global GDP By $1.3 Trillion

(Clean Technica) A new analysis has concluded that by increasing the global share of renewable energy to 36% would increase global GDP by up to $1.3 trillion.

According to a new report published by the International Renewable Energy Agency (IRENA), Renewable Energy Benefits: Measuring the Economics, released today, increasing the global share of renewable energy to 36% by 2030 would increase global gross domestic product (GDP) by up to 1.1%, which equates to roughly $1.3 trillion.